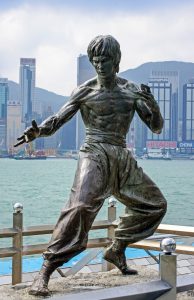

Many” kung fu” fans may recall the famous scene of Bruce Lee film,

“Don’t think, just feel!!”.

Actually, I have used the same phrase when I train Aikido. I sometimes tell my counterpart, “Don’t think about how to move, how to stretch your arm, how to turn your body, just feel and let your body go…”

Anyway, now I have been analyzing the market, and I come up with this phrase.

“Don’t think, just buy!” Some investors have aggressively acquired and thought what to do.

The players who have been actively buying the assets with above behavior are as follows;

1 Real estate companies backed by the securities’ capital

2 Real estate arms under the large Japanese conglomerates

3 Venture businesses expanded into real estate

1 Real estate companies backed by the securities’ capital

Since Lehman brothers clash, basically, Japanese stock market had dropped severely and recovered again. More and more people have got more interested in investments. Due to the COVID-19 pandemic and uncertainty for future, under the lockdown, people have been keen on tapping stock markets. As a result, securities companies seem to be prosperous and became a sort of winners under the pandemic.

Therefore, real estate companies backed by their capitals have always been aggressive and rushed to the properties, purchased, then started thinking what to do.

2 Real estate arms under the large conglomerates

This Q3, the central bank of Japan has implemented several rules: the merged institutions can expect a sort of incentives. Looking at the global financial conditions, financial institutions would seek more other resources to secure their income to survive under the low interest rate era.

Real estate would be one of the cash cows for them. Therefore, regardless of the price and cap rates, they have been aggressively invested into properties so far. This is simply because sooner or later, they should be able to survive with the low income, which will be caused by the interest rates below one percent.

3 Venture businesses in real estate

Looking at past several decades, some companies had been very much prosperous in the market under a certain era. They were very smart in a specific area, accumulated a capital, then put them into the real estate, taking into account the more leverage or capital gain. Interestingly, over the economic cycles, those guys had disappeared in the market. Some were quite aggressive, some over invested, some relied heavily on the debts, and others had suffered their internal conflicts.

Well, this is the history. And the history actually repeats itself.

What we have seen in the market would be a good indication of the dynamism in the future.

Further queries or doubts, please email to ytomizuka@abrilsjp.com

News Letter subscription is here

- Tags

- abondoned, Bruce Lee, capital, Dont think, just feel, Real Estate, securities, stock